Other than housing expenses, automobiles are likely the biggest sucker of wealth in America. One of my favorite paraphrased quotes (please let me know in the comments if you know where this comes from so I can properly credit the actual quote and author), is that people spend their lives driving to a job in a car they can’t afford, to pay a mortgage and the bills they owe from buying stuff on credit they couldn’t afford either. Since cars are depreciating assets and depreciate faster the newer they are, one of the easiest ways to kill your net worth is to purchase cars, especially brand new ones, on credit.

My wife and I have been guilty of exactly this, buying more car than we could afford with cash… two times! First, before my layoff in 2005, we had purchased a 2004 Nissan Maxima and 2004 Scion xB, both on credit. About a year after my layoff, we came to realize how ridiculous it was to have car payments, to be beholden to a job for a car, and to waste so much wealth building potential… so they were sold. All went swimmingly until about 8 years later in 2013, we again fell into the trap of purchasing two new cars on credit! I’ll save our justifications for a later post in My Journey, but after getting really pissed off at ourselves for being hella-stupid again, we agreed to sell those cars, a 2013 Subaru WRX and 2013 Scion xB. This brings us to the blog entry subject.

After setting our sites on smaller fuel-efficient hatchbacks, we purchased a used 2009 Honda Fit Sport with a little under 90,000 miles for the sum of $7000 plus tax and tags. This was purchased using cash from the sale of our vehicles plus some savings, so car payments went bye-bye. Since the value of the car was much lower, the insurance payments went down tremendously compared to our two prior vehicles. And with the Fit, we had fuel mileage of about 28 mpg, certainly better than the 18-24 we had with the WRX and xB.

Once we started cruising around in the Fit, I noticed that a couple people seemed to express concern or even pity; usually not directly spoken, but you could see it on their faces when asking about the change. They seemed worried that we “couldn’t afford” the cars anymore. Even after explaining that it was stupid to pay hundreds of dollars per month for cars and new car insurance, cars that were each driven about 4,000 miles per year, and that I had been biking for my short 2 mile commute to work, I still often heard, “that sort of makes sense, but that was a nice car”. I get it… some people put a ton of value on cars, but in less than a year, no matter how sweet the car, hedonic adaptation (https://www.verywellmind.com/hedonic-adaptation-4156926) takes hold and it becomes just another used car for transportation. Obviously we “could” afford the payments, we simply didn’t want to waste the money and realized these cars were taking a HUGE chunk of wealth!

So how much wealth are we talking? Would you shit your pants if I suggested over $80,000 in only 6 years?! The numbers go up to $100,000 had we not purchased the new cars to begin with, but I’ll focus on our reality in 2015.

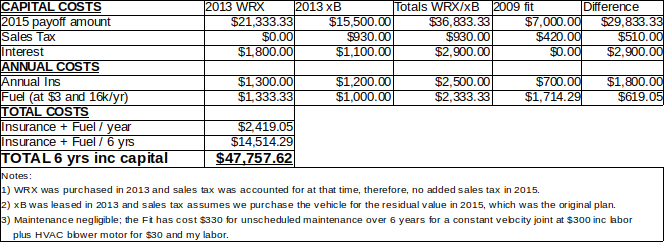

The table below shows that in the 6 years since purchasing the Honda Fit, we’ve spent about $48,000 less on automobiles than we would have if we had kept the WRX and xB. That’s straight cash homie!

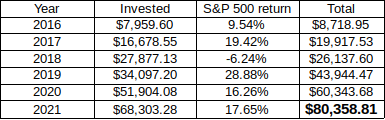

So how does less than $50,000 become over $80,000? I’ll assume that in the 6 years since making this change, we saved $7,959.60 per year ($47,757.62 divided by 6 years). Assuming this was invested in an index fund that tracks the S&P 500, which I personally do and highly recommend to others, the rates of return are shown in the table below. Note that each year, the total invested in the second column equals that earned from the previous year plus $7,959.60, the amount saved per year.

Through the magic of compound interest (https://www.investor.gov/additional-resources/information/youth/teachers-classroom-resources/what-compound-interest), we are over $80,000 richer from selling those new cars and purchasing one economical used car! As mentioned earlier, if I assume we never purchased the WRX and xB, the total purchase prices with tax and interest bring the 6 year savings to over $60,000 and the wealth difference to over $100,000!

I won’t dig into the fine details of automobile true cost to own (TCO) since the folks at Edmonds.com (https://www.edmunds.com/tco.html) and Kelley Blue Book (https://www.kbb.com/new-cars/total-cost-of-ownership/) have done it for us, but this is what brought us to the Honda Fit. We considered a few used vehicles, but projected cost of ownership for the Honda was lower than most other cars we were considering.

So what changes can you make to grow your wealth so you can also say “F That Treadmill”?

- Could you purchase a used economical car with cash instead of one requiring that you borrow money? While our Honda Fit is on the small side, there are plenty of options with more space, better economy, and great reliability to choose from (consider a Prius, Ford CMax, or Toyota Corolla as a sedan or wagon).

- Maybe you’re a 2 or 3-car family and only really need one.

- COVID has allowed many employers and employees to realize working from home is often a great option, so maybe you no longer have a daily commute.

- If you feel like you need a second car for emergencies, you don’t! If you’ve ever had an emergency and drove yourself to a hospital, I’m sure you ‘enjoyed’ a lengthy wait while the staff worked their way through the others in line. You really want to call 911 and take an ambulance to the front of the line.

- If you think you need a second car for an occasional errand, Amazon, grubhub, doordash, and grocery stores deliver most of what you may need.

- Maybe there’s a nearby relative or neighbor that wouldn’t mind letting you borrow their car in a pinch or you could take an Uber for a few bucks.

- If your work commute and typical errands are less than 10 miles, you could ride your bike to help your wallet and health.

- Consider public transit if your home and work are within walking or biking distance of a station.

Sure, having fewer vehicles is less convenient and you miss out on the new car dopamine hit for the first few months, but is adding $100k to your portfolio over the next few years worth a little inconvenience?

I like the Index idea

LikeLiked by 1 person

Index funds are great. They allow diversification with a single purchase to really simplifying investing for us common folks. Thank you for the feedback and reading!

LikeLiked by 1 person

[…] high resale value, we netted about $6000, added $1000 to it, and bought a used Honda Fit (https://fthattreadmill.com/2021/07/05/2009-honda-fit/) that we still own today with over 185k miles. Of course we switched to liability only insurance […]

LikeLike